Senior digital consultant

Senior digital consultant

2016

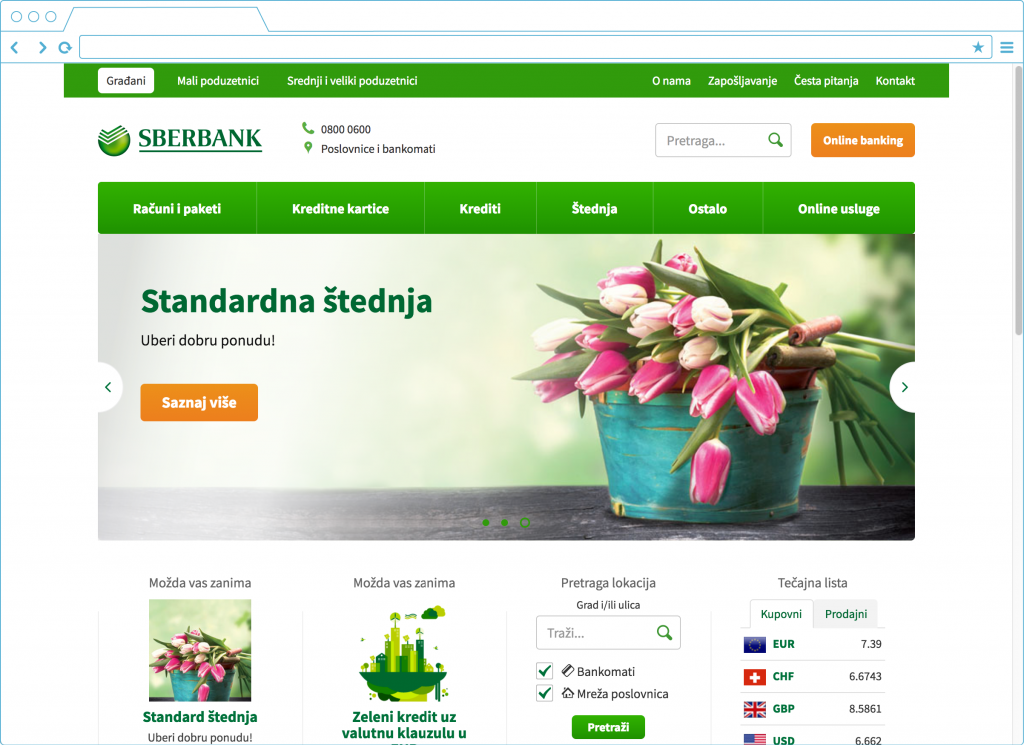

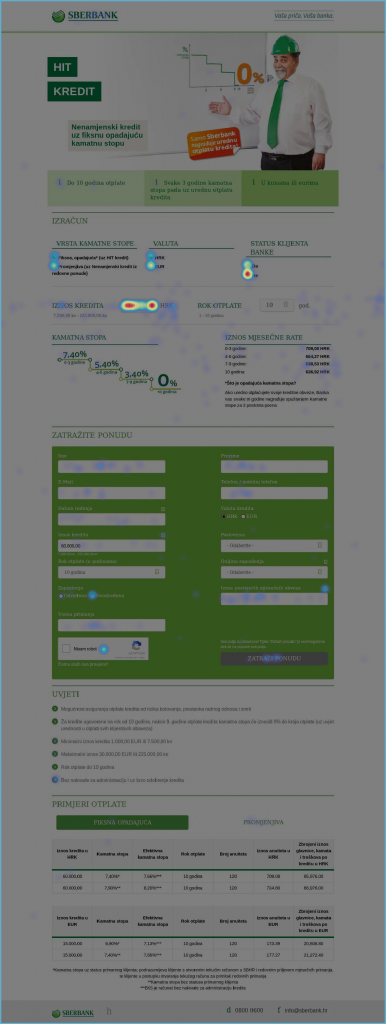

Sberbank corporate public website - migration and launch

Implemented new major version of public web with new modern responsive web design, information architecture (IA) and navigation model for user-friendly and easier browsing. All products content was remodelled to better suite new strong sales-focused strategy with CTA elements on virtually all product pages. To increase organic traffic, all URLs were SEO friendly (rewritten from ground up) and properly migrated (with no organic traffic loss). New CMS deployed and significantly improved internal processes of content ownership and change management procedures.

Special care was taken for web analytics setup, events tracking, proper campaign tagging, and extensive weekly reporting.

Results:

Increased digital sales share (in Bank’s overall) from <1% to more than 8% thru public web channel (equivalent of >800% increase and tenths of millions of Euros of new volume loans). Established evergreen optimized digital campaigns with strong emphasis on delivering best possible ROAS. Implemented new leads management procedures, reporting and close integration with CRM. Implemented new web content management workflow and practices.

My role: channel ownership, project and product management, business analysis, web analytics and reporting, campaign management § Objective: Implement new redesign version of bank’s public web on new CMS (and integrate it with CRM) in order to boost sales significantly § Project duration: 6 months § Years live: 2016 – present

2015

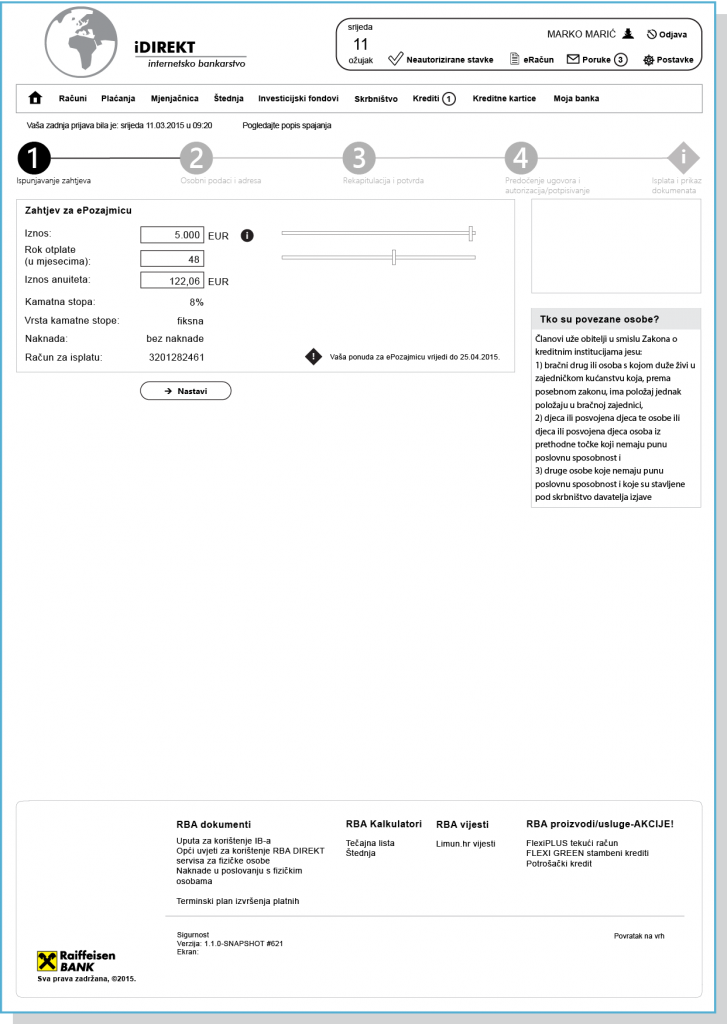

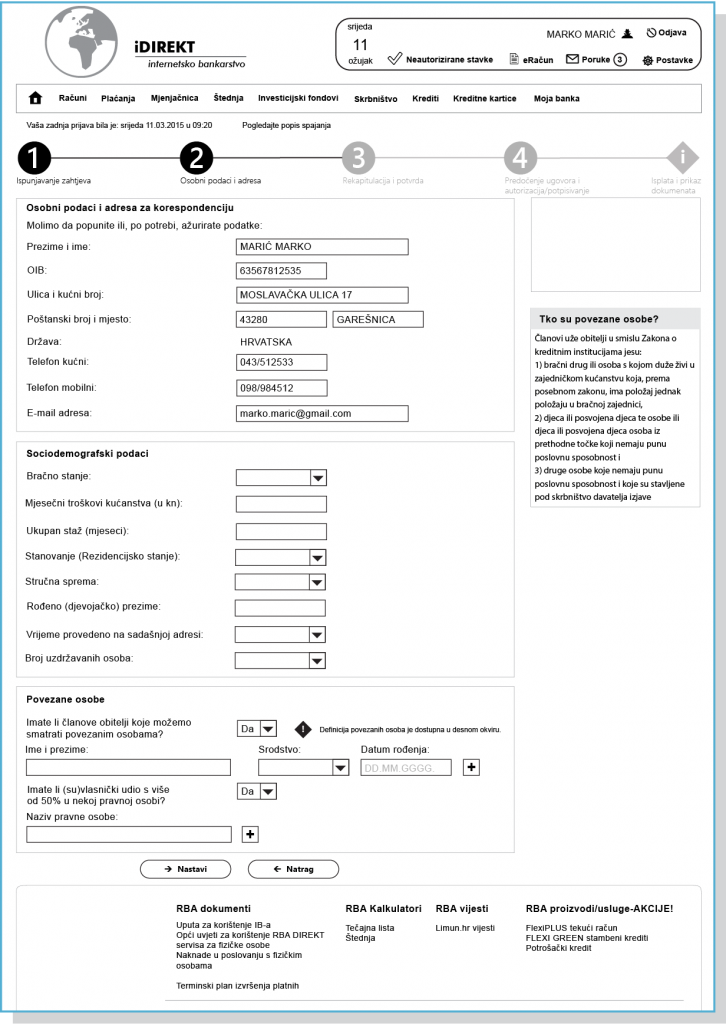

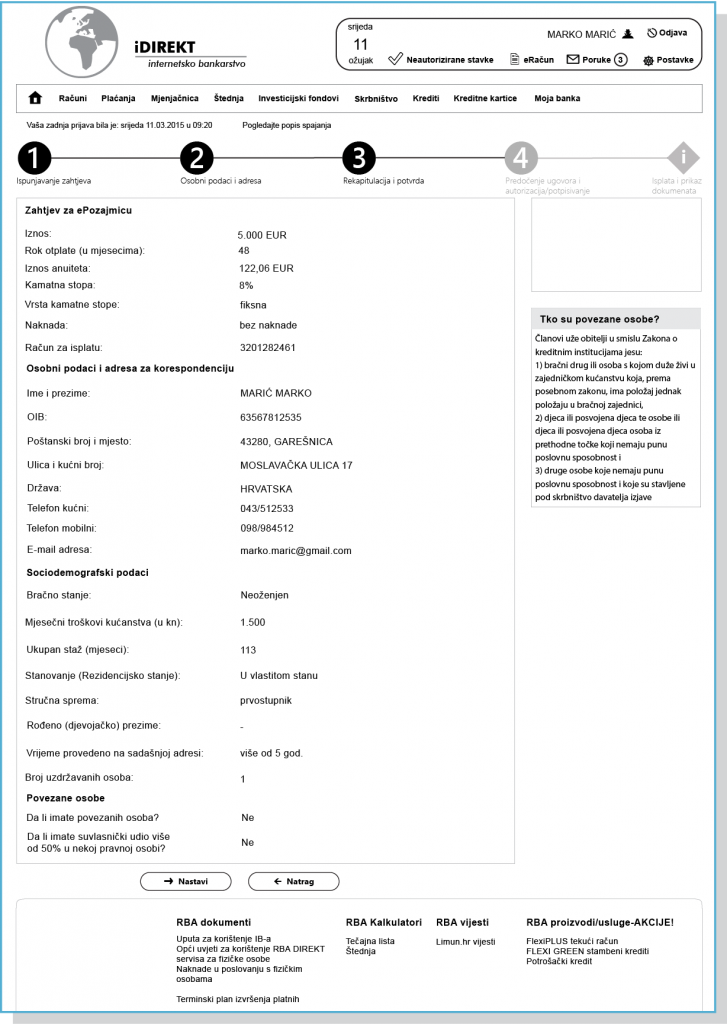

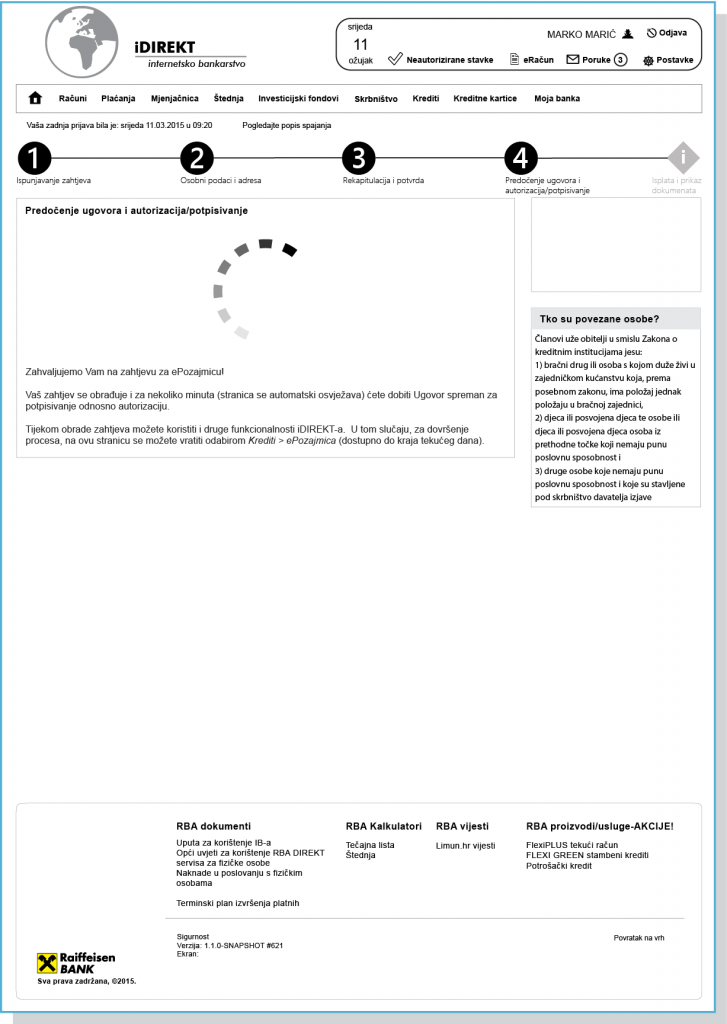

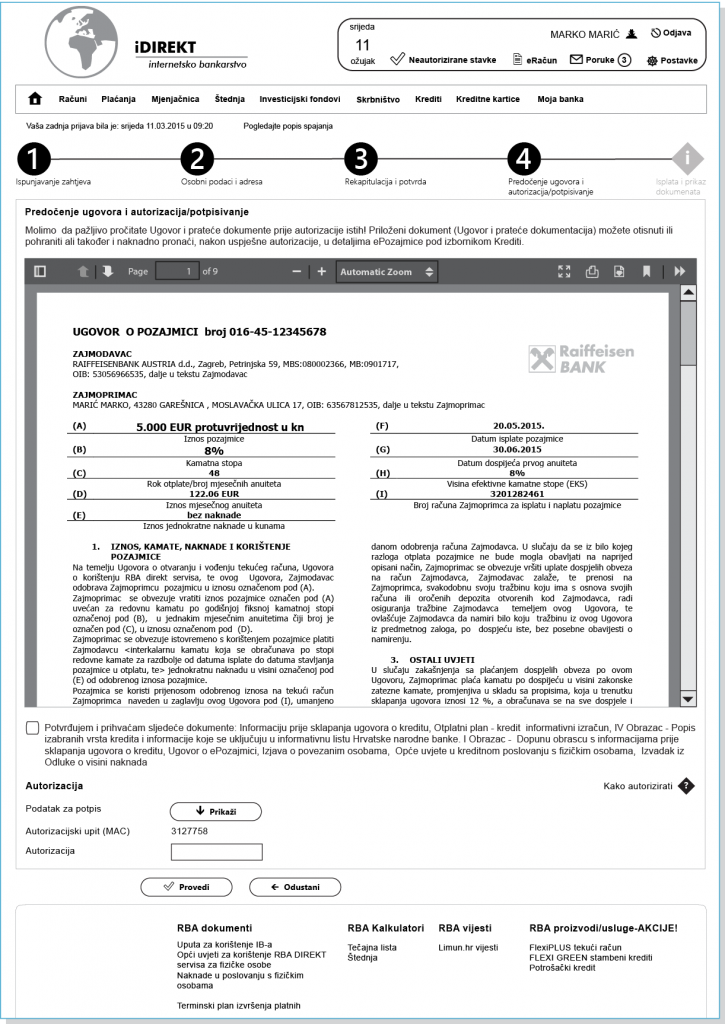

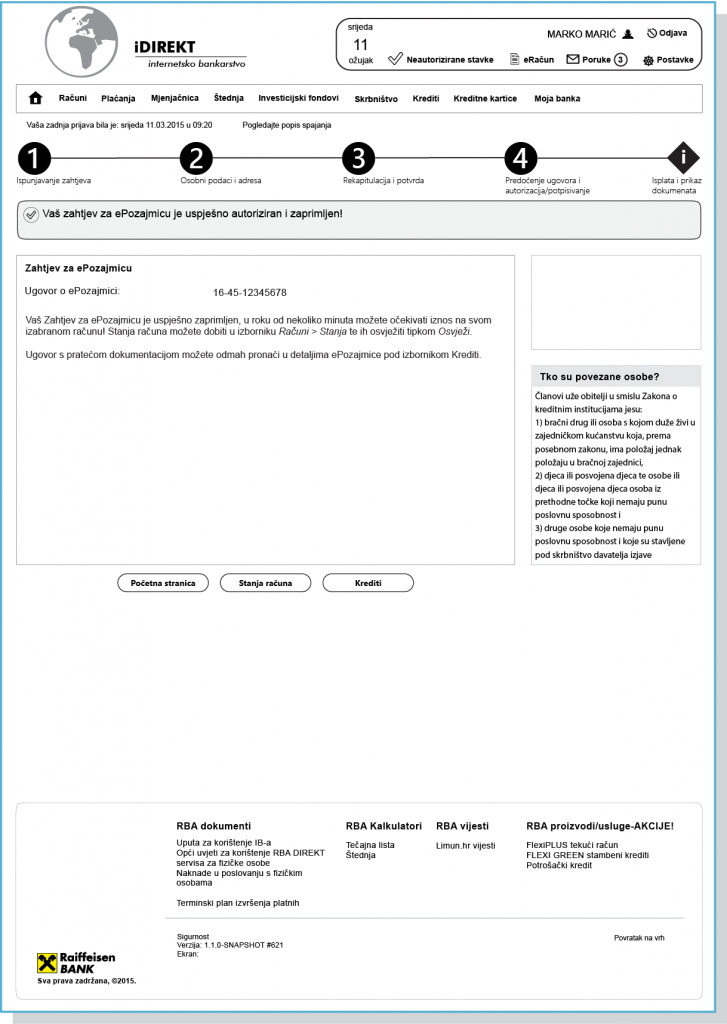

Full end-to-end functionality of loan (and credit card) application implementation in Internet banking

The idea was to enable full end-to-end personal loan disbursement on client’s account in acceptable timeframe.

This challenge was large as the whole loan application process was fragmented on many internal systems of which many don’t mutually communicate. These systems included, among others, Internet banking, loan scoring system, core banking system, document management system and CRM. So, in order for the user to get acceptable user experience all systems interconnection should be well designed and perform flawlessly.

Final result is that after the user confirms last step the loan is disbursed on client’s (chosen) account within one minute, and the whole process from start to end can be performed within 5-6 minutes!

My role: channel ownership, business analysis, application process design, UX design (and UI high-fidelity wireframes), preparation and conducting usability testing § Objective: Enable full realization of personal loan within Internet banking with immediate disbursement § Project duration: 2 years § Years live: 2015 – present

2014

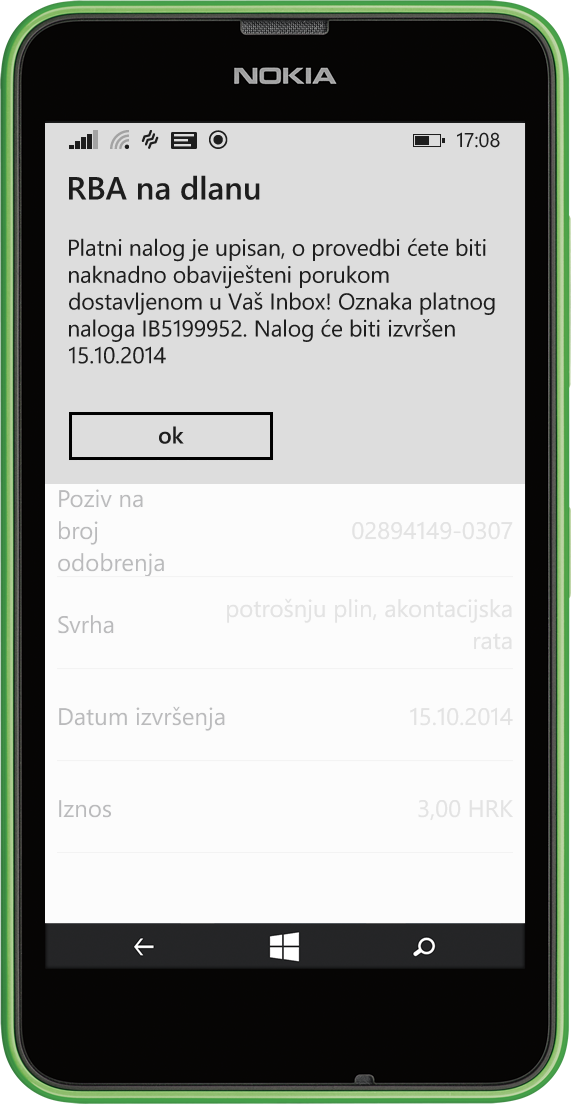

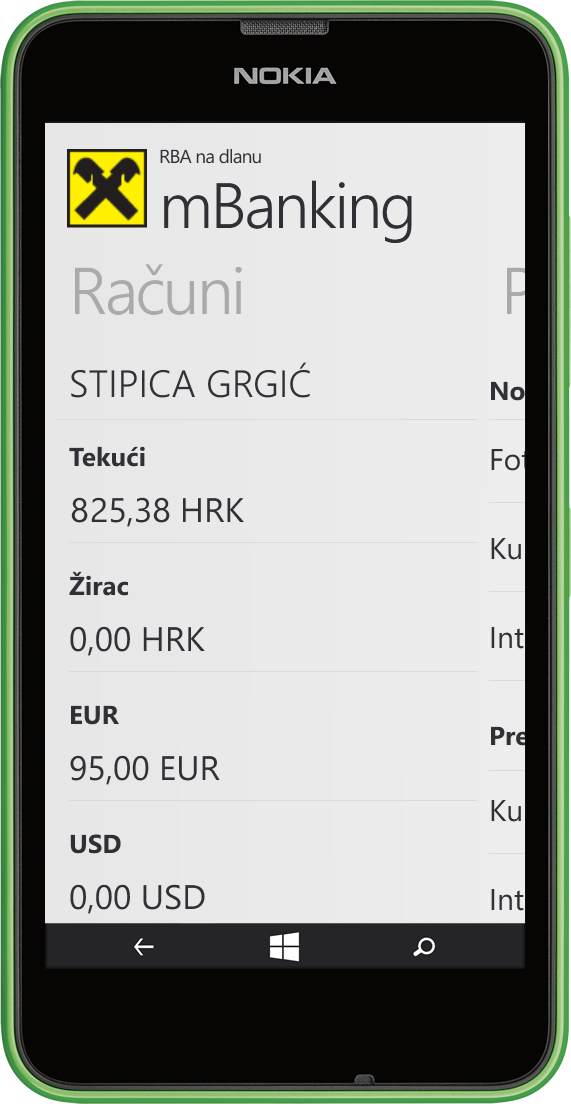

“RBA na dlanu” smartphone based Windows Phone mobile banking

The idea was, in direct collaboration with Microsoft, to develop and publish existing mobile banking app on, then new, platform and in the process improve existing UX and model it to the unique practices of that platform. Great challenge was to replicate all functionalities in short deadline as there was almost 100 different screens.

Result was very elegant full-fledged mobile banking app, came second on the local market, with store rating of 4,2 (out of 5) during first year of availability.

My role: channel ownership, product management, business analysis, UX design (in collaboration with external agency) § Objective: Develop and publish existing full-fledged mobile banking app on a new platform (Windows Phone) § Project duration: 5 months § Years live: 2014 – present

2013

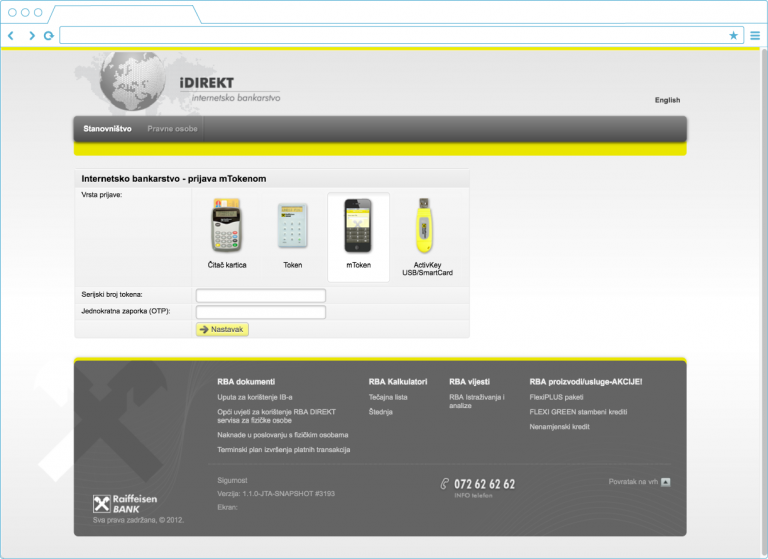

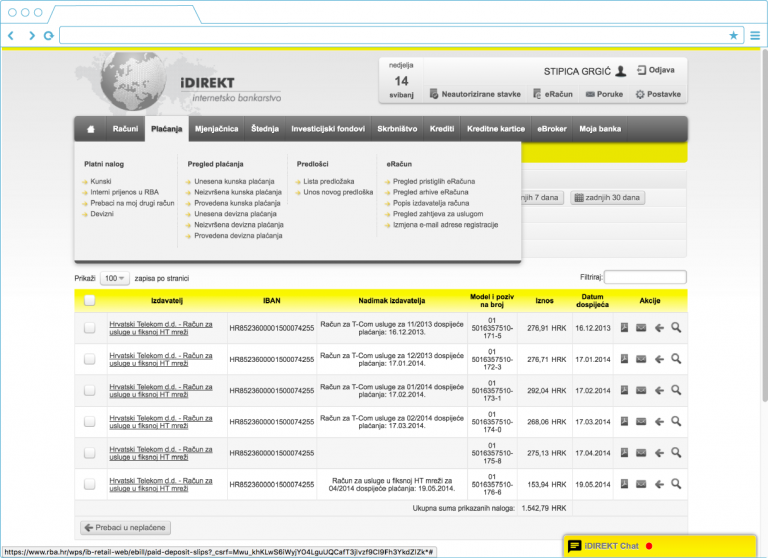

“RBA iDIREKT” Internet banking

My role: channel ownership, product management (for selected products/functionalities), business analysis, UX design steering § Objective: Develop and publish new major version of Internet banking (after last major version was more than 10 years old) and migrate to new application framework § Project duration: 3 years § Years live: 2013 – present

2011

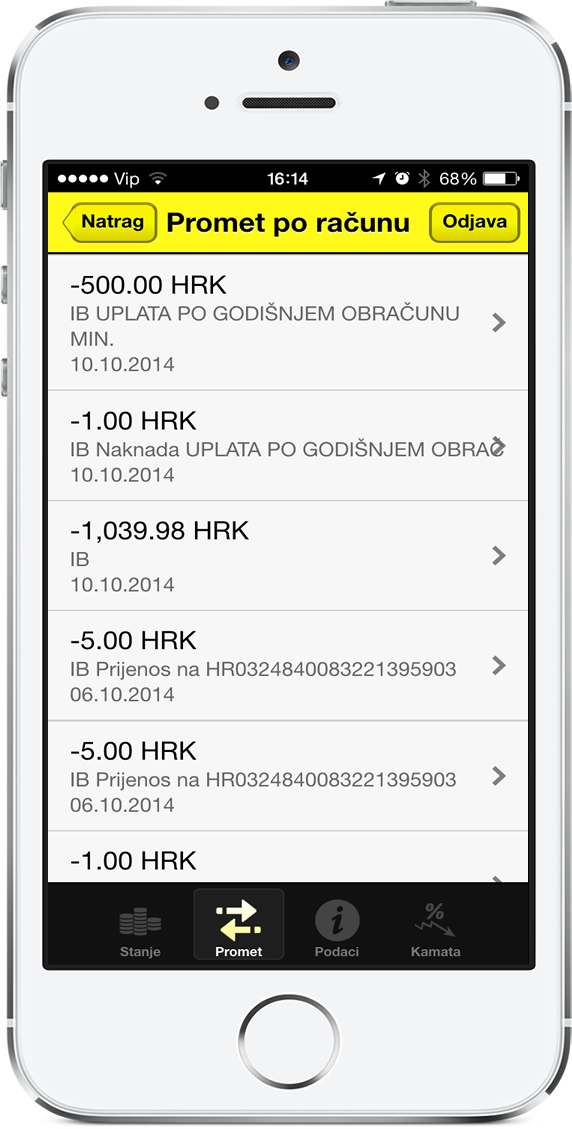

“RBA na dlanu” smartphone based mobile banking

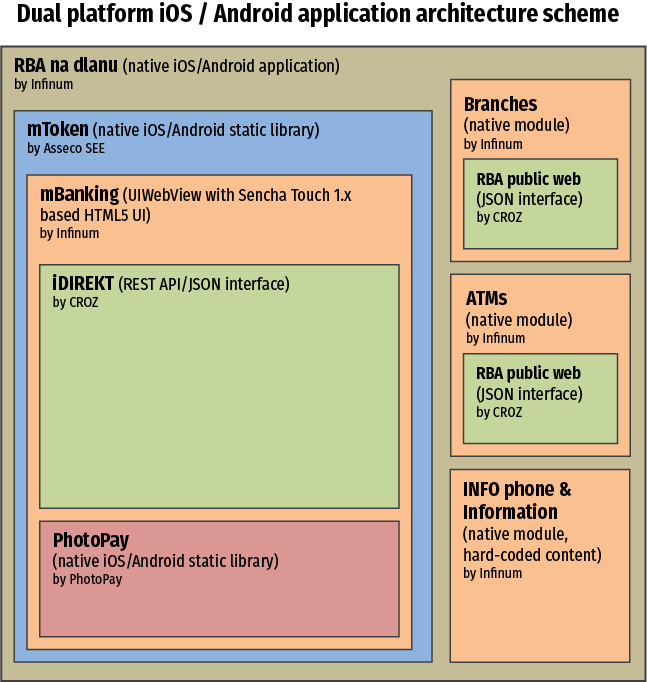

Because there was strong business urge to meet extremely short time-to-market in order to meet it and publish the app on both platforms, iOS & Android, app features a unique complex hybrid (native/HTML5) architecture.

The app offers, besides full-fledged “mBanking”, an integrated “mToken” (soft token) and interactive map and navigation to nearest branch or ATM which set role model, then, on local market in terms of integration of functionalities.

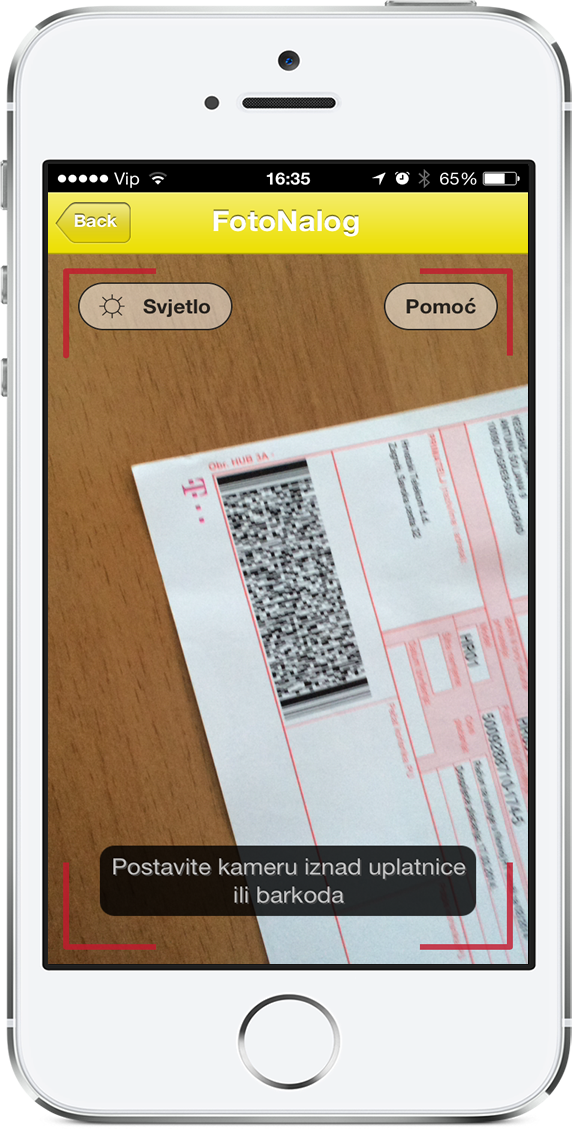

mBanking features include: balance overview of accounts, deposits, loans and credit cards; orders overview and placing unrestricted national payment orders; photo-pay: scanning of the payment slip or the 2D barcode quick payment order; overview of movements and statements of accounts and credit cards with details of every individual transaction; exchange of foreign currencies; end-to-end time depositing of funds; sending and receiving authorized messages.

Due to hybrid architecture, core functionality (mBanking) was completely the same for both platforms which tremendously saved costs on future upgrades, and speeded updates and bug corrections.

One of the most popular features was “photo pay” functionality which enabled to super quickly scan tagged national bills and pay them with almost “one-click”. This feature alone significantly increased mobile payments within the app, as for otherwise most users used it only for non-transactional informing.

My role: product management, UX design, business analysis § Objective: Develop and publish completely new full-fledge mobile banking, native smartphone, app on both platforms (iOS/Android) § Project duration: 7 months § Years live: 2011 – present

2006

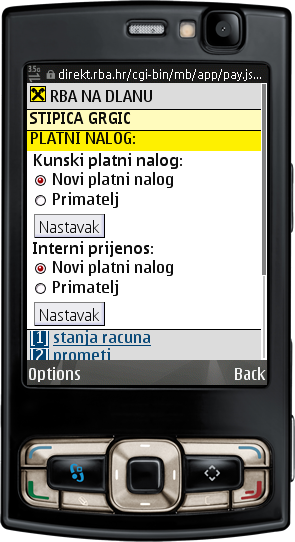

“RBA na dlanu” mobile web based mobile banking

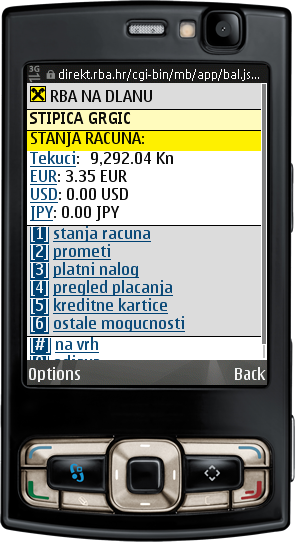

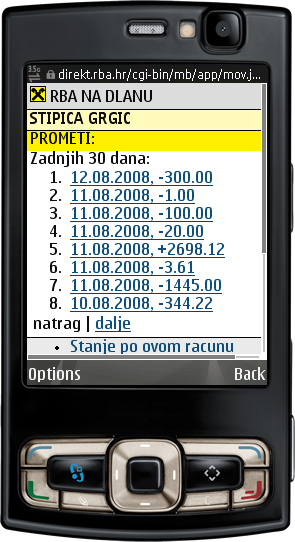

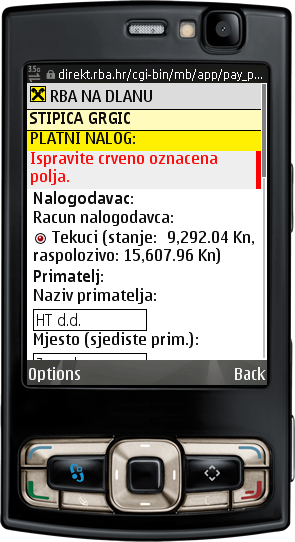

In the days where mobile banking apps were on Java (J2ME) platform with very tricky support on variety of devices we decided to go towards mobile web based solution which proved to have 100% compatibility.

The application featured then cutting-edge UI/UX and super precise content size optimizations where one page/screen would be less than 2KB in size.

Also, it used the same authentication devices and virtually all feature set of existing Internet banking service which included: balance overview of accounts, deposits, loans and credit cards; orders overview and placing unrestricted national payment orders; overview of movements and statements of accounts and credit cards with details of every individual transaction; exchange of foreign currencies; end-to-end time depositing of funds; sending and receiving authorized messages.

My role: product management, business analysis, HTML/CSS design, UX/UI design § Objective: Develop first full-fledged mobile banking which uses existing authentication methods, works on widest variety of mobile devices and consumes least possible network data § Project duration: 8 months § Years live: 2006 – 2012

2002 - 2009

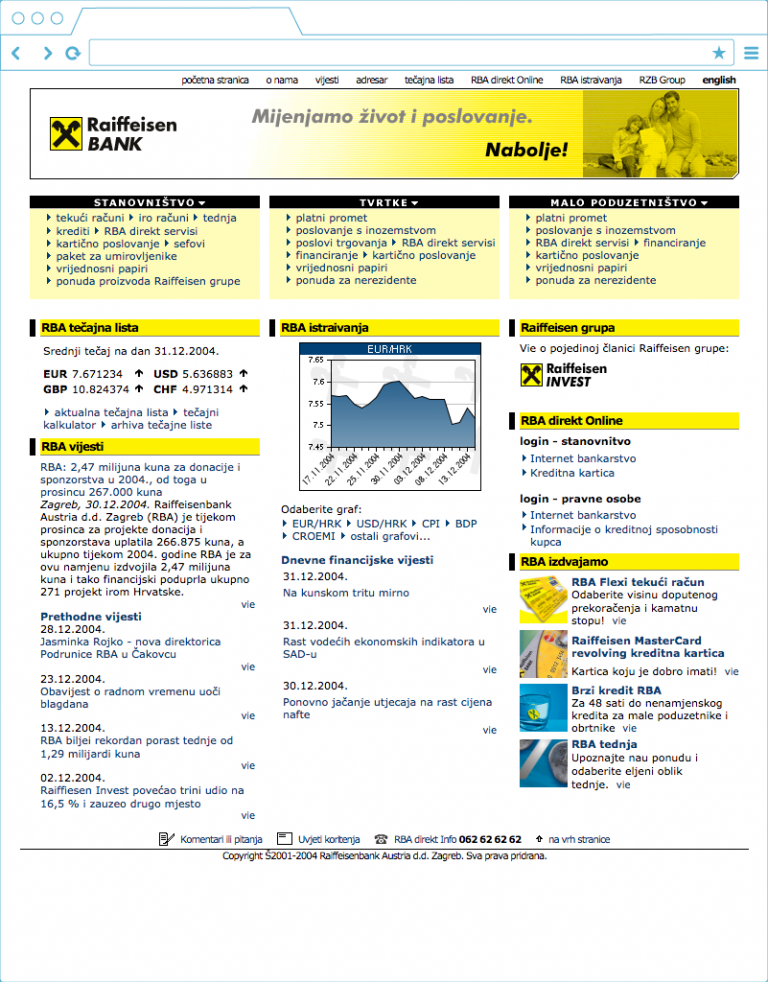

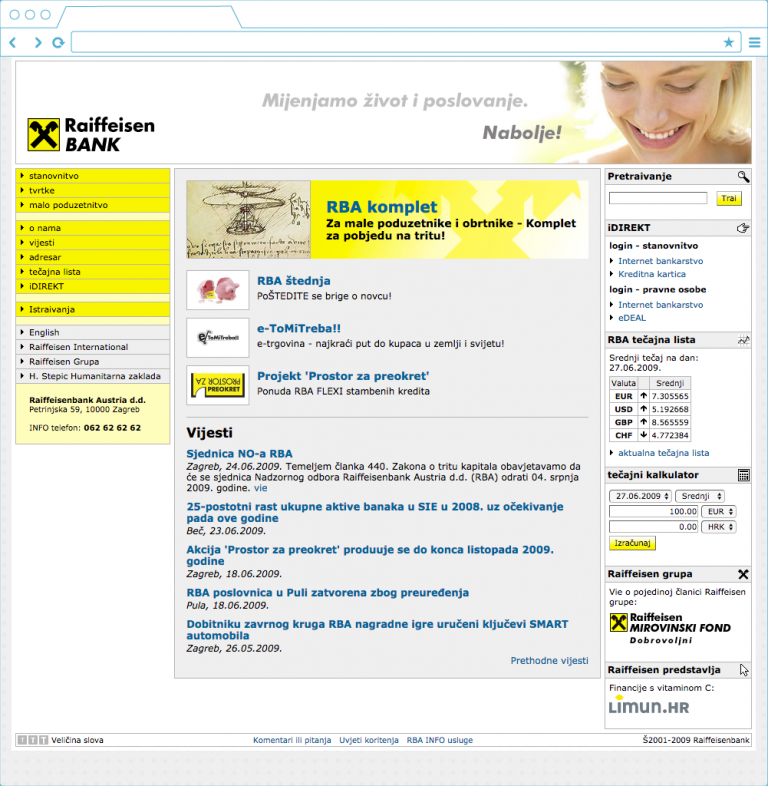

“RBA INFO web” corporate public website (3 generations) & CMS

A team of only two members had built a dynamic corporate public website on an uncommon technological platform/framework.

The team not only built from scratch a UI design, architecture & DB design and application code, but also completed testing, final launch and later maintenance.

The website featured bilingual 10K+ documents and pages, 30K+ daily sessions and advanced custom made application-level web analytics.

My role: product and project management, business analysis, software architecture, DB design, UI/HTML/CSS design § Objective: Develop and maintain in-house complete public web solution with tailor-made web content management system (CMS) § Project duration: varied (as three major versions were developed and launched) § Years live: 2002 – 2014

2004

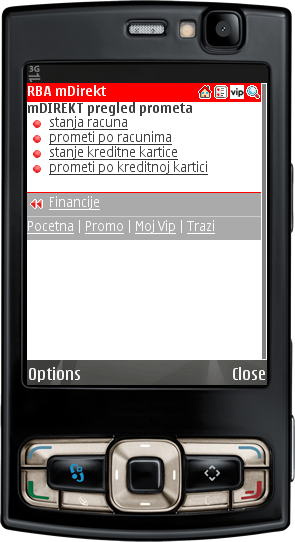

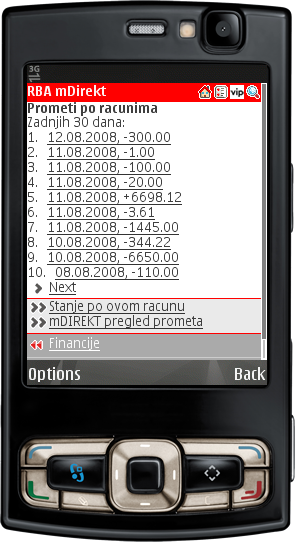

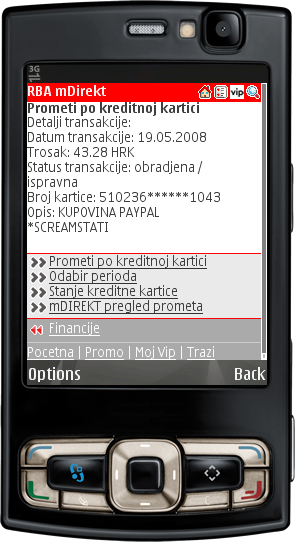

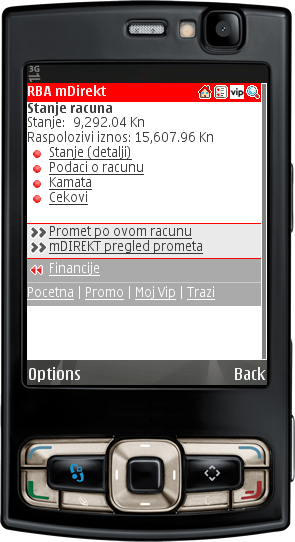

“RBA mDIREKT Pregled prometa” light mobile banking

The idea was to make “light” mobile banking service with unique custom made (no PIN, no password) user authentication (in direct partnership with mobile carrier).

The application featured transaction-less functionalities like all accounts balances with details, all credit cards balances with details, all accounts and credit card activities with transaction details.

The key feature of the app was close integration with mobile carrier where carrier would supply to the bank mobile subscriber number (MSISDN) encrypted in a HTTP request header needed to identify the user. Also, not less important, the service was very closely integrated into carrier’s own mobile portal (Vodafone LIVE!) which was mobile data fee free (in the time where mobile data was not really affordable).

The application hasn’t had too many registered users, mostly it was working only with one of the two major carriers (as with the other one we couldn’t settle on legal grounds), but it definitely showed future trend in popularity and closeness bank can have with their clients with such a practical service. For example, 80% of registered users were logging in 50 times, on average, per month!

My role: product management, business analysis, UX design § Objective: Develop company’s first ever mobile banking with basic functionalities § Project duration: 5 months § Years live: 2004 – 2010